Expert Guidance With Questis

Financial Counseling Services

Navigate your financial journey with Questis, where personalized counseling will guide you towards wise money management and lasting financial health are on offer.

Expert Advice for Personal Financial Clarity

Transforming Finances With Professional Insights

Financial empowerment through knowledge is a vital tool for anyone looking to improve their current situation. Questis’ financial counseling services offer personalized guidance to help you understand and manage your finances better. Whether it’s budgeting, debt management, investment strategy, or planning for major life events, our experts provide the insight and support you need. We focus on empowering you with the knowledge and tools necessary to make informed decisions, reduce financial stress, and achieve your financial goals. It’s about taking a proactive approach to your finances, setting the stage for a more prosperous and worry-free future.

Questis: Financial Counseling at Your Fingertips

^

Discover how Questis’ financial counseling services help provide clarity and control throughout your financial life, paving the way for a more secure future.

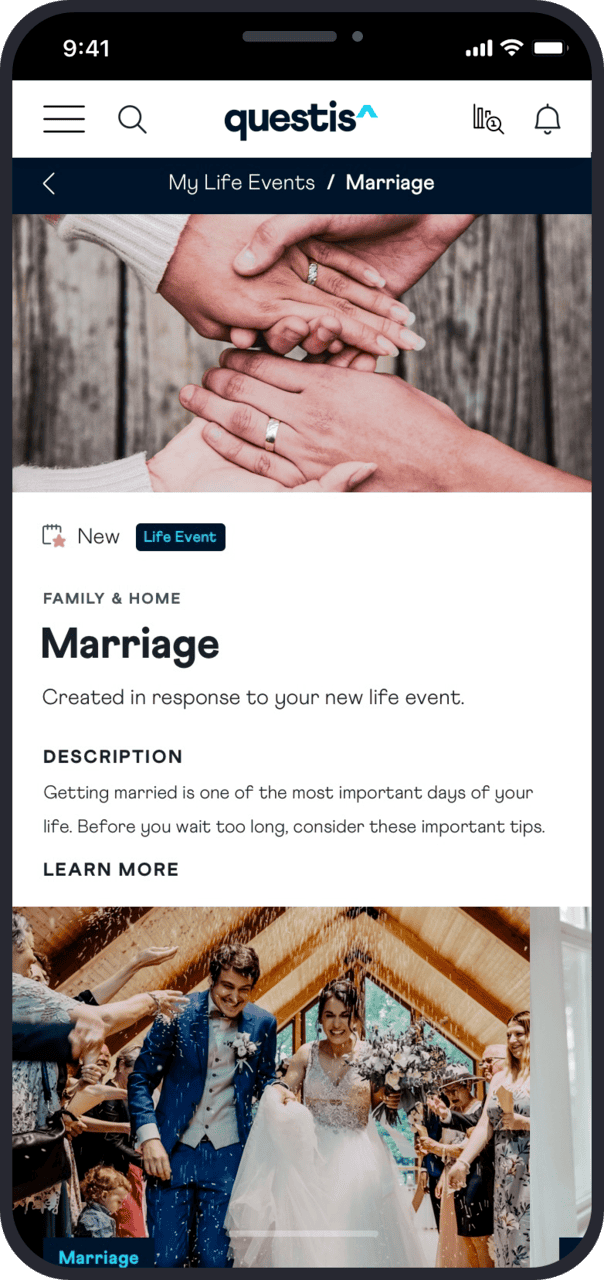

The Questis app enhances your financial counseling experience by providing easy access to your financial data, counseling session summaries, and personalized tips. It acts as a convenient extension of our counseling services, ensuring that you have constant support and resources to help you make the best financial decisions.

See how coaching helped Sophia with her financial goals

Sophia, a struggling 35 year old paid off $25,000 of debt and saved an $8,000 emergency fund with the help of her Questis Financial Empowerment Coach.

Inform Your Employer About Questis^

Your Roadmap to Financial Stability

- Spending – Wise Spending Choices, Understanding Credit, Budgeting for Credit Health, Minimizing High-Interest Debts

- Protection – Credit Fraud Prevention, Identity Theft Protection, Regular Credit Checks, Secure Financial Transactions

- Debt – Efficient Debt Management, Timely Bill Payments, Reducing Credit Balances, Debt-to-Income Ratio Improvement

- Save – Building Emergency Funds, Savings to Reduce Debt, Credit Stability, Saving to Avoid High-Credit Utilization

Questions?

See coaching in action^

Schedule a 20-minute session with our Head of Coaching by selecting

“tell me more about coaching” in the contact form.